In the dynamic and ever-changing world of entrepreneurship, finance is critical to the transformation of breakthrough ideas into viable enterprises. Startups around the world are constantly looking for financial assistance for their growth and development. This article digs into the complex world of startup funding strategies for entrepreneurs, showcasing classic possibilities such as angel investors and venture money, while also throwing light on emerging choices such as crowdfunding platforms.

Traditional Funding: Exploring Angel Investment and Venture Capital

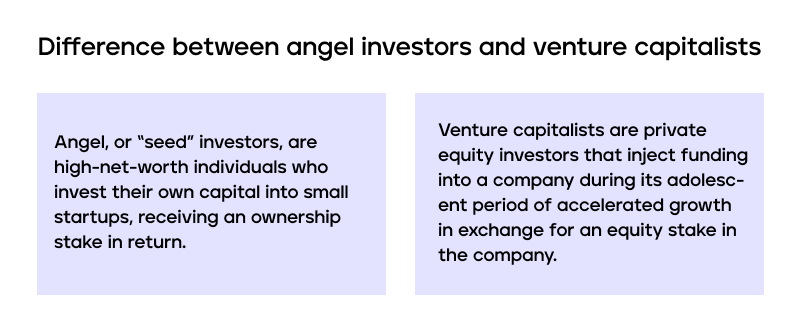

Understanding the dynamics of venture capital and angel investments is crucial for startup financial strategies. Angel investors are high-net-worth people who offer funds in exchange for stock ownership in the firm. They frequently provide not just financial resources, but also significant industry expertise and relationships. Venture capital businesses, on the other hand, are professional investment firms that manage pooled funds from many investors. They often invest in firms with tremendous growth potential, providing significant money infusions in exchange for ownership.

The success stories of firms such as Facebook and Uber, which got early financing from different types of investors, like angel investors or venture capitalists, demonstrate the usefulness of these strategies. These firms took use of their investors’ financial backing and expertise to expand quickly and disrupt whole sectors.

Newer Options: Crowdfunding Platforms

Innovative startup funding options, such as crowdfunding platforms, have revolutionized how young companies secure financial support. Crowdfunding platforms have emerged in the last few years as an innovative approach to fundraising for entrepreneurs. Startups may propose their ideas directly to a large audience of prospective investors through sites like Kickstarter and Indiegogo. Contributors make financial contributions in return for perks or early access to the startup’s product or service.

Crowdfunding democratizes the fundraising process and may be an effective marketing strategy in terms of building buzz and interest in a startup’s offering. Success stories like the Pebble smartwatch, which garnered more than $10 million on Kickstarter, show the potential of crowdsourcing in making ideas a reality.

How Does Startup Fundraising Work

Startup fundraising valuation is a multi-stage process that includes everything from creating a great pitch deck to negotiating with investors and finding the best private equity fundraising software. A successful pitch deck should communicate the startup’s value proposition, market opportunity, competitive advantage, and financial projections concisely. Entrepreneurs must also find and approach possible investors whose interests are similar to theirs.

Founders must be prepared to address value, stock distribution, and investment terms during negotiations. It is critical to find a balance between obtaining the required capital and ensuring that the conditions are advantageous for the startup’s long-term growth.

The fundraising process for startups typically unfolds in several structured stages:

- Preparation

- Market Research: Understand your target market, competitors, and customer needs.

- Business Plan: Develop a comprehensive business plan detailing your vision, strategy, and financial projections.

- Pitch Deck: Create a compelling pitch deck that succinctly presents your business idea, market opportunity, competitive advantage, team, and financial needs.

- Identifying Potential Investors

- Research: Identify potential investors who align with your startup’s industry, stage, and values, including angel investors, venture capitalists, and crowdfunding platforms.

- Networking: Leverage networking events, industry conferences, and professional connections to get introductions to potential investors.

- Engagement

- Initial Contact: Reach out to potential investors through cold emails, introductions, or at networking events.

- Pitching: Present your pitch deck and business plan to interested investors to explain your vision and the investment opportunity.

- Due Diligence

- Investors will conduct a thorough review of your startup’s team, market, product, financials, and legal structure to assess the risk and potential return on investment.

- Negotiation and Terms

- Term Sheet: If an investor decides to proceed, they will issue a term sheet outlining the terms of the investment, including valuation, equity, and governance.

- Negotiation: There may be negotiations to finalize the terms of the investment to the satisfaction of both parties.

- Funding

- Legal Documentation: Once terms are agreed upon, legal documents are prepared and signed.

- Capital Transfer: The investment is transferred to the startup, providing the funds needed for growth.

- Post-Investment

- Growth and Scaling: Use the funds to execute your business plan, grow your team, develop your product, and expand your market presence.

- Investor Relations: Maintain regular communication with investors, providing updates on progress, milestones, and financials.

Why Is Fundraising Necessary?

For starters, it offers the funds required to create new goods, expand operations, and enter new markets. Many firms would struggle to survive, let alone prosper, without investment. Furthermore, fundraising may provide more than simply cash assistance. Investors frequently give coaching, direction, and access to key networks, which may be critical to the success of a firm.

Fundraising also validates a startup’s concept and business strategy by proving to potential clients and partners that their service is in demand. This confirmation may increase credibility and open the door to strategic relationships and prospects for growth.

Platforms and Software for Startup Fundraising

In the digital era, entrepreneurs must manage the financing process properly by using a startup fundraising platform. There are several platforms and software solutions available to help expedite fundraising activities. Tools for cap table administration, investor relations, and compliance tracking are available through proprietary software such as Gust and Capshare. These systems assist startups in maintaining accurate records with the help of AI-powered technologies and openness with funders.

Furthermore, fundraising software with an open source such as CiviCRM and Odoo might be beneficial to low-budget companies. These systems include customizable customer relationship management, financial, and data management solutions.

Startups should research extensive software overviews on specialized websites and examine their demands and financial limits before deciding on which software to utilize.

Summary

Startup finance is the lifeblood of innovation, enabling entrepreneurs to turn their visions into reality. Traditional fundraising routes such as angel investors and venture capital, as well as newer ones such as crowdsourcing, provide a varied range of funding options. Fundraising is an important stage for businesses since it provides not only financial funding but also mentorship and networking possibilities. Startups may traverse the route to success in the competitive business world by grasping the complexities of startup funding by applying the right software.